In today's interconnected world, investors from various countries are looking to diversify their portfolios by investing in different markets. For Indian citizens, the U.S. stock market is a particularly appealing option due to its size, liquidity, and potential for growth. But can Indian citizens buy stock in the US? The answer is yes, they can, but there are certain regulations and procedures to follow. This article will provide a comprehensive guide to help Indian investors navigate the process.

Understanding the Basics

Before diving into the details, it's important to understand the basics of stock trading. A stock represents a share of ownership in a company. When you buy a stock, you become a partial owner of that company, and you can profit from its success through dividends and capital gains.

Regulatory Requirements

Indian citizens can buy stocks in the U.S. as long as they comply with the regulations set by the U.S. Securities and Exchange Commission (SEC) and the Foreign Account Tax Compliance Act (FATCA). Here are some key requirements:

- Tax Identification Number (TIN): Indian citizens need to obtain a TIN from the IRS to comply with FATCA. This can be done by filing Form W-8BEN.

- Brokerage Account: Indian citizens must open a brokerage account with a U.S.-based broker that is registered with the SEC. The broker will help facilitate the purchase and sale of stocks.

- Reporting: Indian citizens must report their U.S. stock investments on their annual income tax return.

Steps to Buy U.S. Stocks

- Research and Choose a Broker: Indian citizens have a variety of options when it comes to brokers. It's important to choose a reputable broker that offers low fees, good customer service, and access to the U.S. stock market.

- Open a Brokerage Account: Once you have chosen a broker, you will need to open a brokerage account. This process typically involves filling out an application, providing identification, and completing a risk assessment.

- Fund Your Account: After your account is approved, you will need to fund it with the amount of money you want to invest.

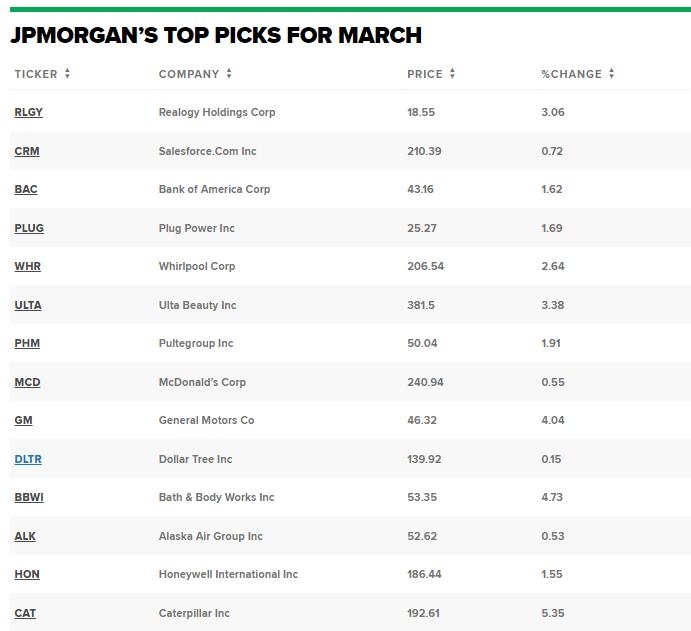

- Research and Select Stocks: Research companies you are interested in and select the ones you want to invest in. You can use financial websites, stock market apps, and other resources to help you with your research.

- Place a Trade: Once you have selected your stocks, you can place a trade through your brokerage account. You can choose to buy stocks individually or through a mutual fund or exchange-traded fund (ETF).

Case Study: Investing in Apple (AAPL)

Let's say an Indian citizen wants to invest in Apple (AAPL), one of the most popular and successful companies in the world. Here's how they can do it:

- Research Apple: The investor researches Apple's financials, market position, and growth prospects. They determine that Apple is a good investment.

- Choose a Broker: The investor chooses a broker that offers access to the U.S. stock market.

- Open a Brokerage Account: The investor opens an account with the broker and funds it with the desired amount.

- Place a Trade: The investor places an order to buy Apple stock through their brokerage account.

Conclusion

Investing in the U.S. stock market can be a great way for Indian citizens to diversify their portfolios and potentially earn higher returns. By understanding the regulatory requirements and following the steps outlined in this article, Indian investors can successfully buy stocks in the U.S.