In the ever-evolving world of finance, it's crucial to stay informed about the latest trends and indicators that can predict market movements. One such indicator that has recently caught the attention of investors is Barclays' stock market forecast. This article delves into what this indicator reveals and why it suggests continued gains for US stocks.

Understanding Barclays' Indicator

Barclays, one of the world's leading financial institutions, has developed a comprehensive indicator that analyzes various factors, including economic data, market trends, and company performance, to predict future stock market movements. This indicator has proven to be quite accurate in the past, making it a valuable tool for investors looking to make informed decisions.

Key Factors Influencing the Indicator

Several key factors influence Barclays' indicator, including:

- Economic Data: The indicator closely monitors economic reports such as GDP, unemployment rates, and consumer spending. Positive economic data often indicates a strong market, while negative data can suggest a downturn.

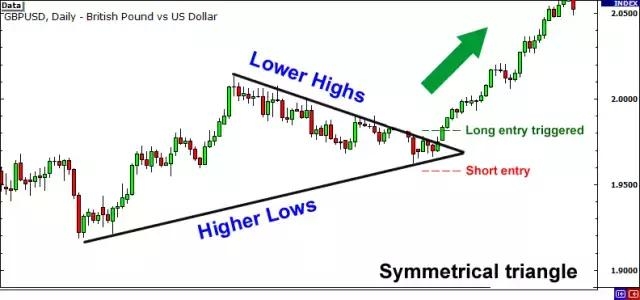

- Market Trends: Historical market trends play a significant role in the indicator. By analyzing past market movements, Barclays can predict future trends and adjust its forecast accordingly.

- Company Performance: The performance of individual companies also impacts the indicator. Strong earnings reports and positive outlooks from major companies can boost the market, while poor performance can lead to a decline.

Recent Indicator Suggests Continued Gains

The latest reading of Barclays' indicator suggests that US stocks are likely to continue their upward trend. This is based on several factors:

- Positive Economic Data: The latest economic reports have shown strong growth in key areas, such as GDP and consumer spending. This indicates that the economy is healthy and growing, which is generally good for the stock market.

- Market Trends: Historical market trends have shown that when the indicator is positive, the market tends to follow suit. This trend suggests that the current positive indicator is a good sign for investors.

- Company Performance: Many major companies have reported strong earnings and positive outlooks, which has contributed to the overall positive sentiment in the market.

Case Studies and Examples

To further illustrate the accuracy of Barclays' indicator, let's look at a few case studies:

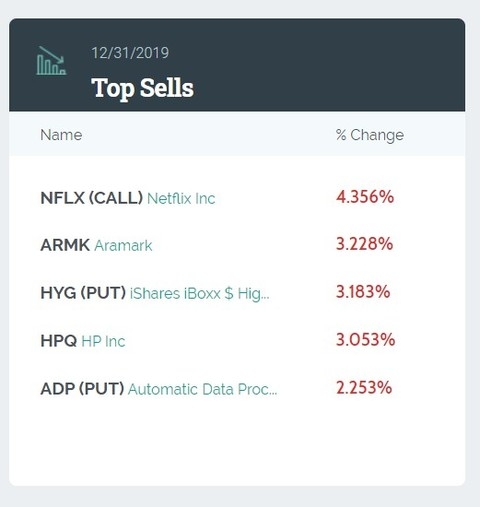

- 2019: In early 2019, the indicator predicted a strong market. This proved to be true, as the S&P 500 index gained nearly 30% that year.

- 2020: Despite the economic uncertainty caused by the COVID-19 pandemic, the indicator remained positive. This suggested that the market would recover, which proved to be the case as the S&P 500 index gained over 16% in 2020.

Conclusion

Barclays' indicator is a valuable tool for investors looking to predict market movements. The latest reading suggests that US stocks are likely to continue their upward trend, making it an exciting time for investors. By staying informed and using reliable indicators like Barclays', investors can make more informed decisions and potentially achieve greater returns.