In the fast-paced world of financial markets, staying informed about the stock prices of major companies is crucial for investors. One such company that has gained significant attention is the Bank of Montreal (BMO), a leading financial institution in Canada. In this article, we will delve into the Bank of Montreal US stock price, its trends, and factors influencing it. Whether you are a seasoned investor or just starting out, this guide will provide you with valuable insights into BMO’s US stock performance.

Understanding the Bank of Montreal US Stock Price

The Bank of Montreal US stock price refers to the current market value of BMO’s shares listed on U.S. exchanges. Investors can track the price of BMO stock by monitoring the New York Stock Exchange (NYSE) or the Toronto Stock Exchange (TSX), where the bank is also listed. The stock price is determined by supply and demand dynamics in the market, influenced by various factors such as economic conditions, company performance, and investor sentiment.

Factors Influencing the Bank of Montreal US Stock Price

Economic Conditions: The performance of the Bank of Montreal US stock price is closely tied to the broader economic landscape. Factors such as interest rates, inflation, and GDP growth can significantly impact the stock’s value. For instance, higher interest rates can boost the bank’s net interest margins, leading to increased profitability and potentially higher stock prices.

Company Performance: BMO’s financial performance, including revenue, net income, and earnings per share, plays a crucial role in determining its stock price. Strong financial results can boost investor confidence and drive up share prices, while poor performance can lead to a decline in stock value.

Market Sentiment: Investor sentiment can have a profound impact on the Bank of Montreal US stock price. Factors such as political events, market trends, and industry-specific news can sway investor confidence, leading to significant price volatility.

Regulatory Changes: Changes in financial regulations can affect the profitability and operations of BMO. For example, stricter regulations may increase compliance costs and reduce profitability, potentially impacting the stock price.

Historical Performance and Trends

Analyzing the historical performance of the Bank of Montreal US stock price can provide valuable insights into its future potential. Over the past few years, BMO has demonstrated consistent growth, with the stock price reaching new highs in some periods. However, like any investment, the stock price has also experienced periods of volatility.

Case Studies

To illustrate the impact of various factors on the Bank of Montreal US stock price, let’s consider a few case studies:

Interest Rate Hike: In 2018, the Federal Reserve raised interest rates, leading to a boost in BMO’s net interest margins. This resulted in higher earnings and a surge in the stock price.

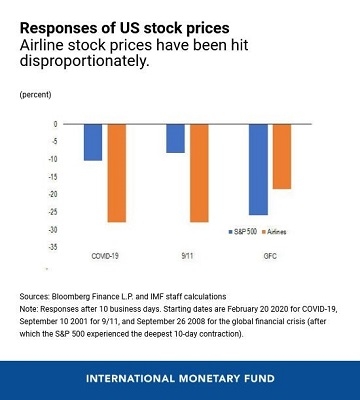

COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in 2020 initially led to a sharp decline in the Bank of Montreal US stock price. However, as the economy began to recover, the stock price gradually stabilized and even experienced a surge in certain periods.

Conclusion

Understanding the Bank of Montreal US stock price and the factors influencing it is crucial for investors looking to invest in this leading financial institution. By analyzing historical performance, market trends, and economic conditions, investors can make informed decisions about their investments in BMO. Whether you are a long-term investor or seeking short-term gains, staying informed about the Bank of Montreal US stock price is key to achieving your investment goals.