In the ever-evolving global financial landscape, investors are increasingly seeking ways to diversify their portfolios. One popular strategy involves investing in a mix of U.S. and international stocks. This article delves into the concept of the 80/20 rule, which suggests that investors should allocate 80% of their capital to U.S. stocks and 20% to international stocks. By understanding this approach, investors can potentially maximize returns while mitigating risks.

Understanding the 80/20 Rule

The 80/20 rule, also known as the Pareto Principle, posits that 80% of the effects come from 20% of the causes. In the context of investing, this principle suggests that a significant portion of a portfolio's performance can be attributed to a smaller number of investments. By focusing on high-performing stocks, investors can achieve substantial returns with a relatively small investment.

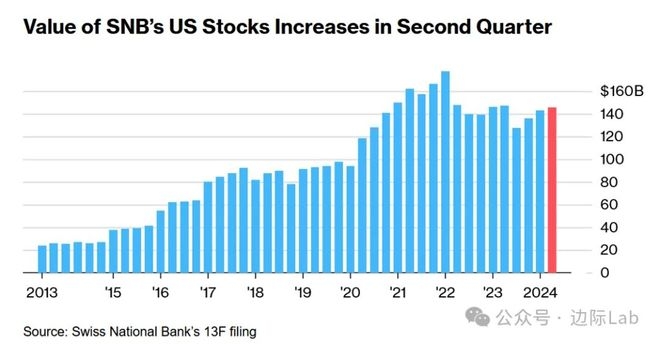

The Benefits of Investing in U.S. Stocks

Investing in U.S. stocks offers several advantages. The U.S. stock market is one of the largest and most liquid in the world, providing investors with access to a wide range of companies across various industries. Additionally, the U.S. has a strong regulatory framework, which helps protect investors and ensures fair trading practices.

The Role of International Stocks

While U.S. stocks may offer stability and growth potential, international stocks can provide exposure to different markets and currencies. This diversification can help mitigate risks associated with economic and political events in any single country. International stocks also offer the opportunity to invest in emerging markets, which can offer higher growth potential compared to mature markets.

Finding the Right Balance

The 80/20 rule suggests that investors should allocate 80% of their capital to U.S. stocks and 20% to international stocks. This balance allows investors to benefit from the stability and growth potential of the U.S. market while also tapping into the opportunities offered by international markets.

Case Study: Apple Inc. and Tencent Holdings Limited

To illustrate the benefits of diversifying a portfolio with international stocks, consider the case of Apple Inc. and Tencent Holdings Limited. Apple, a U.S.-based technology company, has been a strong performer in the U.S. stock market. On the other hand, Tencent, a Chinese technology giant, has experienced significant growth in the international market.

By investing in both Apple and Tencent, an investor can benefit from the stability of Apple's stock while also capitalizing on the growth potential of Tencent. This demonstrates how the 80/20 rule can be applied to achieve a well-diversified portfolio.

Conclusion

The 80/20 rule provides a strategic approach to diversifying a portfolio by allocating a significant portion of capital to U.S. stocks and a smaller portion to international stocks. By understanding this approach and conducting thorough research, investors can potentially maximize returns while mitigating risks. Remember, it's crucial to stay informed and adapt your investment strategy as the global financial landscape evolves.