The NASDAQ 100, a widely-followed index of the top 100 non-financial companies listed on the NASDAQ, is a significant indicator of the technology and growth sectors of the stock market. Its current price can reflect market trends, investor sentiment, and the overall health of the tech industry. In this article, we will delve into the NASDAQ 100's current price, its implications, and what it means for investors.

Understanding the NASDAQ 100

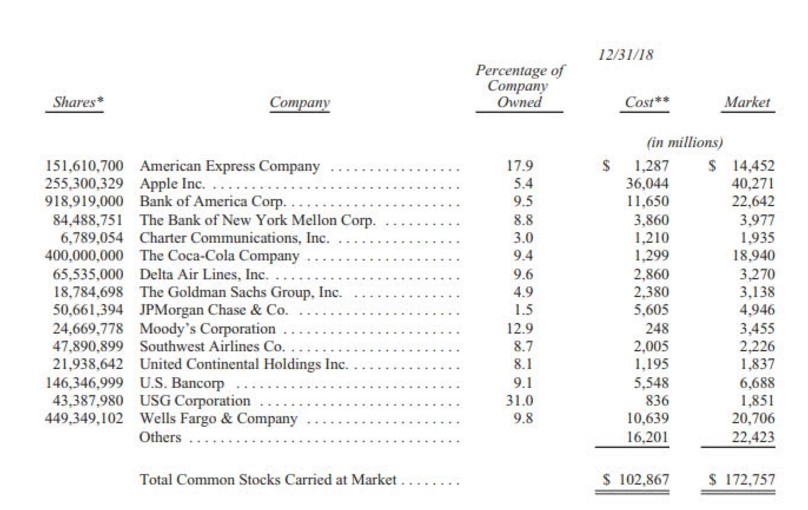

The NASDAQ 100 includes companies such as Apple, Microsoft, Amazon, and Google's parent company, Alphabet. These companies are leaders in their respective industries, and the index provides a snapshot of the technology sector's performance. The index is weighted by market capitalization, meaning the largest companies have the most influence on the index's price.

Current NASDAQ 100 Price

As of the latest data, the NASDAQ 100 is trading at approximately $13,000. This figure can fluctuate daily due to market conditions, investor sentiment, and economic news. It's important to note that the index price is not the same as the individual stock prices of the companies within the index.

Implications of the Current Price

The current price of the NASDAQ 100 can have several implications:

Market Sentiment: A higher index price can indicate strong market sentiment and confidence in the technology sector. Conversely, a lower index price may reflect concerns or uncertainty.

Economic Indicators: The NASDAQ 100 is often used as an economic indicator, particularly for the tech industry. Its performance can provide insights into the overall health of the economy.

Investment Opportunities: The current price can help investors make informed decisions about whether to invest in the technology sector or individual companies within the index.

Case Study: Apple's Impact on the NASDAQ 100

A prime example of how individual companies can influence the NASDAQ 100 is Apple. When Apple's stock price rises, it can significantly boost the index's price, as Apple is one of the largest companies within the NASDAQ 100. Conversely, if Apple's stock price falls, it can negatively impact the index.

Factors Influencing the NASDAQ 100 Price

Several factors can influence the NASDAQ 100's price:

Economic Data: Economic reports, such as GDP growth, unemployment rates, and inflation data, can impact investor sentiment and the NASDAQ 100's price.

Political Events: Global political events, such as elections or trade disputes, can create uncertainty and volatility in the stock market.

Company Earnings: The earnings reports of companies within the NASDAQ 100 can significantly impact the index's price.

Technological Advancements: Breakthroughs in technology can drive investor interest and boost the NASDAQ 100's price.

In conclusion, the NASDAQ 100's current price is a vital indicator of the technology sector's performance and the overall health of the stock market. By understanding the factors that influence the index's price and its implications, investors can make informed decisions about their investments.