Introduction

In the ever-evolving real estate market, understanding the dynamics between housing development and infrastructure share price is crucial for investors and homeowners alike. This article delves into the intricate relationship between these two factors, highlighting the impact they have on the real estate industry. By analyzing current trends and providing insights into the future, we aim to help you make informed decisions.

The Link Between Housing Development and Infrastructure

Housing development and infrastructure are inextricably linked. The availability of quality infrastructure, such as roads, schools, and public transportation, significantly influences the demand for housing in a particular area. Conversely, the growth of housing development often drives the need for improved infrastructure.

Infrastructure Share Price: A Barometer of Development

Infrastructure share prices serve as a reliable indicator of the overall development in a region. When infrastructure companies see an increase in share prices, it usually signifies a positive outlook for the housing market in that area. This is because investors perceive improved infrastructure as a catalyst for growth in the real estate sector.

Current Trends in Housing Development and Infrastructure Share Prices

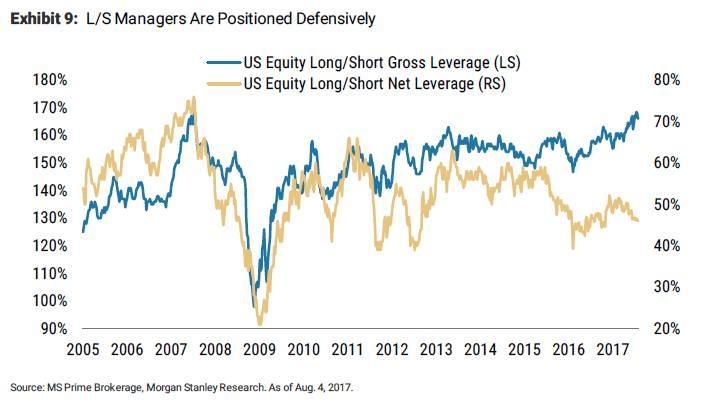

In recent years, we have seen a surge in infrastructure projects across the United States. This trend has been driven by the need to address aging infrastructure and meet the growing demand for housing. As a result, infrastructure share prices have experienced a steady rise.

One notable example is the construction of new highways and public transportation systems in major cities. These projects have not only improved the quality of life for residents but have also boosted housing demand in surrounding areas. Consequently, infrastructure share prices have soared.

The Impact of Infrastructure on Housing Development

Infrastructure plays a crucial role in shaping housing development. Improved infrastructure tends to lead to higher property values, increased demand for housing, and greater investment opportunities. Conversely, poor infrastructure can hinder housing development and lead to stagnant property values.

For instance, a recent study found that cities with robust public transportation systems experienced higher real estate prices compared to those without. This highlights the significant impact infrastructure has on housing development.

Investing in Infrastructure and Housing Development

For investors looking to capitalize on the housing market, investing in infrastructure companies can be a wise move. By doing so, you can benefit from the growth in housing development and infrastructure share prices. However, it is crucial to conduct thorough research and stay informed about current trends to make well-informed decisions.

Conclusion

Understanding the relationship between housing development and infrastructure share prices is vital for anyone involved in the real estate market. By analyzing current trends and keeping abreast of future developments, you can make informed decisions and capitalize on the opportunities presented by the housing and infrastructure sectors.