Are you considering stock options as a part of your investment strategy? If so, understanding the concept of exercise price is crucial. The exercise price, also known as the strike price, is a key factor in determining the profitability of your options. This article will delve into what exercise price is, its significance, and how it affects your investment decisions.

What is Exercise Price?

The exercise price is the price at which an option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset, such as a stock, ETF, or index. It is set when the option is created and remains constant until the option expires.

Why is Exercise Price Important?

The exercise price plays a vital role in the valuation of stock options. It determines the profit potential of an option and can significantly impact the overall return on investment. Here's why exercise price is important:

- Profit Potential: The higher the exercise price, the greater the potential profit if the stock price rises above the exercise price. Conversely, a lower exercise price can lead to immediate profits if the stock price increases quickly.

- Risk Management: The exercise price helps investors manage risk. For example, if you own a put option with an exercise price of

100 and the stock price falls to 90, you can exercise the option and sell the stock at100, limiting your loss to 10 per share. - Market Dynamics: The exercise price reflects market expectations. A higher exercise price may indicate that the market expects the stock price to rise, while a lower exercise price may suggest a bearish outlook.

Calculating Profitability

To calculate the profitability of an option, you need to subtract the exercise price from the current stock price. If the result is positive, you have a profit. For example, if the stock price is

Case Study:

Imagine you purchase a call option on Company XYZ with an exercise price of

Factors Influencing Exercise Price

Several factors can influence the exercise price of an option:

- Market Conditions: Economic indicators, company earnings reports, and overall market sentiment can all impact the exercise price.

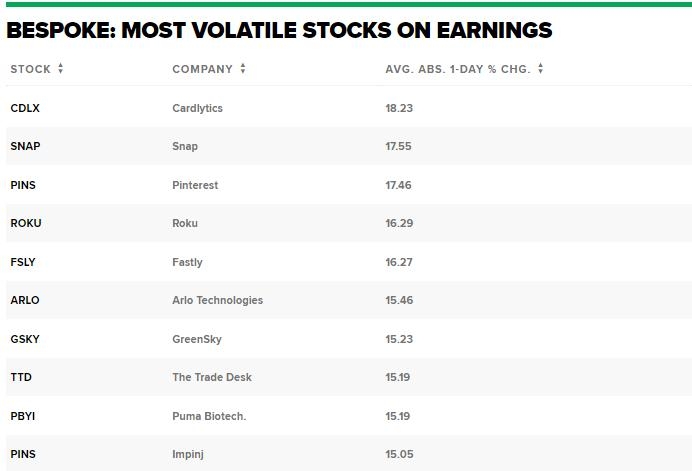

- Volatility: Higher volatility can lead to higher exercise prices, as investors expect greater price swings in the future.

- Time to Expiration: The time remaining until the option expires can also influence the exercise price. Generally, as the expiration date approaches, the exercise price tends to decrease.

Conclusion

Understanding the exercise price of stock options is essential for making informed investment decisions. By considering the profit potential, risk management, and market dynamics associated with the exercise price, you can increase your chances of successful trading. Always do your research and seek professional advice when evaluating stock options.