Introduction: The New York Stock Exchange (NYSE) is one of the most prominent stock exchanges in the world, offering a wide range of investment opportunities across various sectors. Understanding the different sectors within the NYSE is crucial for investors looking to diversify their portfolios and capitalize on market trends. In this article, we will explore the key sectors of the NYSE, providing insights into their characteristics, performance, and potential investment opportunities.

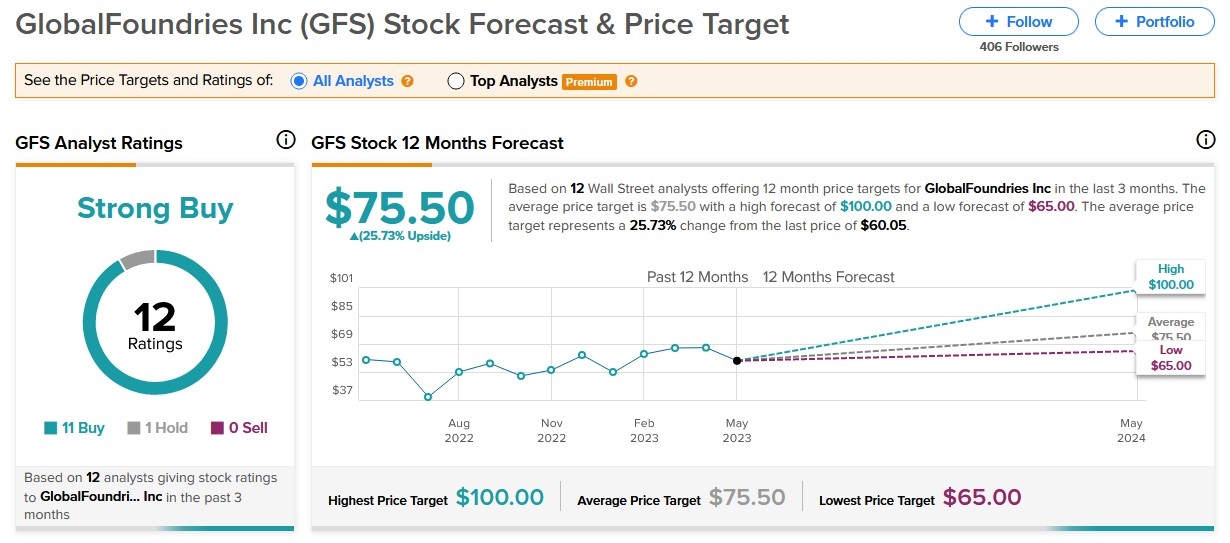

Technology Sector: The technology sector is a major component of the NYSE, with companies like Apple, Microsoft, and IBM leading the way. This sector encompasses businesses involved in the development, manufacturing, and distribution of technology products and services. The technology sector has historically demonstrated strong growth and has been a significant driver of the overall market. Investors seeking long-term growth potential may consider allocating a portion of their portfolio to this sector.

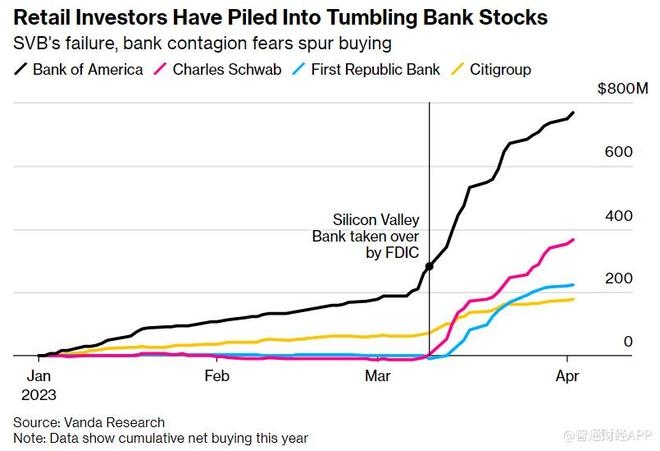

Financial Sector:

Consumer Discretionary Sector: The consumer discretionary sector includes companies that produce goods and services that are not considered necessities. This sector includes industries such as retail, automotive, and leisure. The performance of the consumer discretionary sector is closely tied to economic conditions and consumer spending. Investors looking for exposure to consumer trends and brand-name companies may consider this sector.

Healthcare Sector: The healthcare sector is a critical component of the NYSE, encompassing pharmaceutical companies, biotechnology firms, and healthcare providers. This sector has been experiencing steady growth, driven by advancements in medical technology and an aging population. Investors seeking long-term growth and stability may find the healthcare sector to be a compelling investment opportunity.

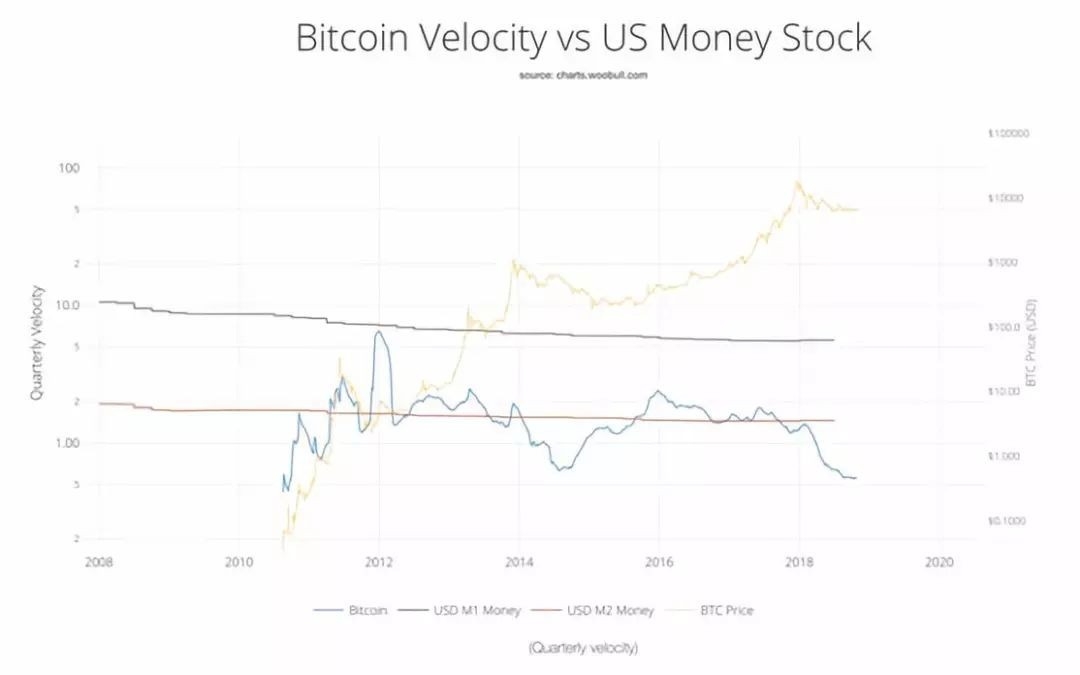

Energy Sector: The energy sector includes companies involved in the exploration, production, and distribution of oil, natural gas, and other energy sources. This sector is subject to volatile commodity prices and regulatory changes. Investors looking for exposure to the energy market and potential for significant returns may consider the energy sector, but they should also be prepared for market fluctuations.

Industrial Sector: The industrial sector includes companies involved in the manufacturing, construction, and transportation industries. This sector is sensitive to economic cycles and can experience rapid growth during periods of economic expansion. Investors seeking exposure to the industrial sector may consider companies involved in infrastructure, aerospace, and industrial equipment manufacturing.

Case Study: One notable example of a company within the technology sector is Apple Inc. (AAPL). Over the past decade, Apple has consistently demonstrated strong growth, driven by its innovative products and services. The company's market capitalization has soared, making it one of the most valuable companies in the world. Investors who invested in Apple during its early stages have seen significant returns, highlighting the potential of the technology sector.

Conclusion: Understanding the different sectors within the New York Stock Exchange is essential for investors looking to build a well-diversified portfolio. By analyzing the characteristics, performance, and potential investment opportunities of each sector, investors can make informed decisions and capitalize on market trends. Whether you are seeking long-term growth, stability, or exposure to specific industries, the NYSE offers a wide range of sectors to choose from.