In the ever-evolving world of financial markets, the copper price on NASDAQ has become a crucial indicator for investors and industry experts alike. As a fundamental metal, copper plays a pivotal role in various sectors, from construction to technology. This article delves into the intricacies of the copper price on NASDAQ, exploring its significance, factors influencing it, and potential future trends.

Understanding the Copper Price on NASDAQ

The copper price on NASDAQ is determined by the trading activity of copper futures contracts. These contracts are agreements to buy or sell copper at a predetermined price and date in the future. The NASDAQ exchange, known for its technological innovation and extensive market coverage, has become a key platform for copper trading.

Factors Influencing the Copper Price on NASDAQ

Several factors influence the copper price on NASDAQ, making it a dynamic and complex market. Here are some of the key factors:

- Supply and Demand: The fundamental principle of supply and demand significantly impacts the copper price. Factors such as mining production, inventory levels, and global economic growth play a crucial role in determining the supply and demand dynamics.

- Economic Indicators: Economic indicators, such as GDP growth, inflation rates, and employment data, can influence the copper price. For instance, a strong economic outlook may lead to increased demand for copper, driving up prices.

- Currency Fluctuations: The value of the US dollar can also impact the copper price. Since copper is priced in US dollars, a weaker dollar makes copper more expensive in other currencies, potentially increasing demand and pushing up prices.

- Political and Geopolitical Factors: Political instability or geopolitical tensions in copper-producing countries can disrupt supply, leading to higher prices.

Recent Trends and Analysis

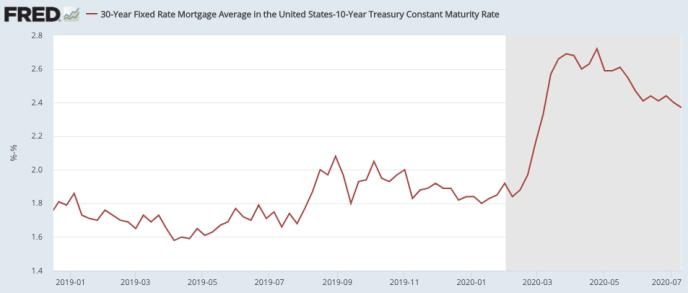

In recent years, the copper price on NASDAQ has experienced significant volatility. For instance, in 2020, the price of copper dropped sharply due to the global economic downturn caused by the COVID-19 pandemic. However, as the economy recovered, the price of copper began to rise again.

One notable trend in recent years has been the increasing importance of renewable energy in the global energy mix. As more countries invest in renewable energy infrastructure, the demand for copper has surged, driving up prices.

Case Study: The Impact of the US-China Trade War on Copper Prices

The US-China trade war, which began in 2018, had a significant impact on the copper price on NASDAQ. As tensions escalated, tariffs were imposed on copper imports, leading to increased costs for manufacturers and a decrease in demand. This, in turn, put downward pressure on copper prices.

Conclusion

The copper price on NASDAQ is a critical indicator for investors and industry experts alike. By understanding the factors that influence the price and staying informed about market trends, investors can make more informed decisions. As the global economy continues to evolve, the copper price on NASDAQ will remain a key area of focus for market participants.